Be sure. Be Right.

Pascal is a comprehensive ecosystem with versatile compliance solutions, designed to support and enhance your Know Your Customer (KYC) and Anti-Money Laundering (AML) processes.

Onboard clients and third-parties with your branding

Screen for sanctions, enforcements, PEPs and adverse media

Automated via API and integrations with HubSpot and Microsoft

Trusted by 150 global organisations with 600 users active in financial services, logistics, tax & legal services and consultancy

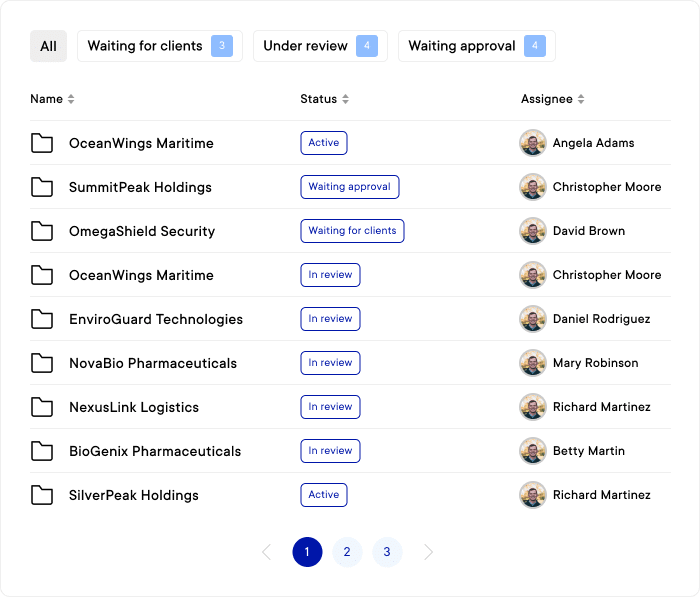

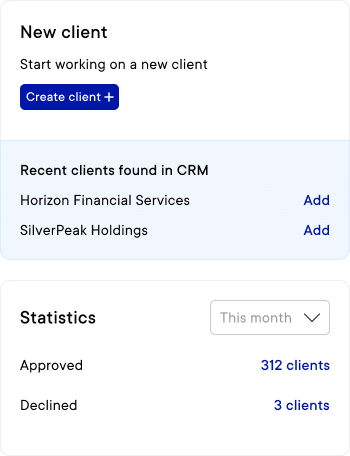

Faster Client Onboarding

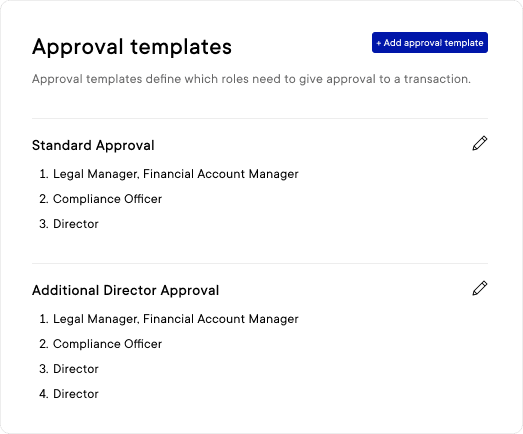

Eliminate the complexity of onboarding clients and third parties. Let Pascal handle the heavy lifting by automating the collection and validation of essential data and documents. Our solution allows you to easily create and manage custom KYC/AML questionnaires, workflows and internal approval processes, all tailored to your business requirements.

Integrated entity screening

Customisable forms and questionnaires

Integrated third-party ID verification

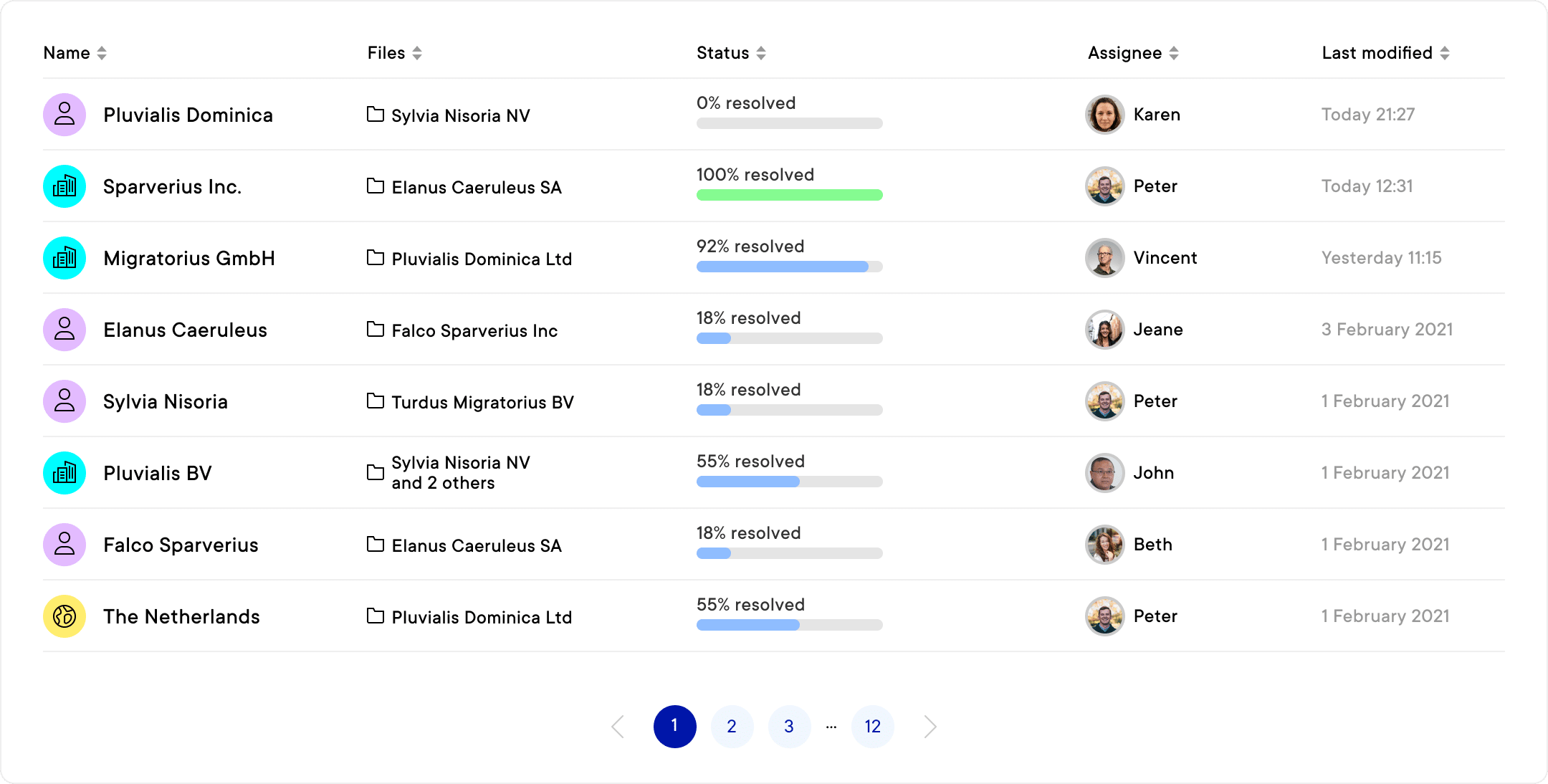

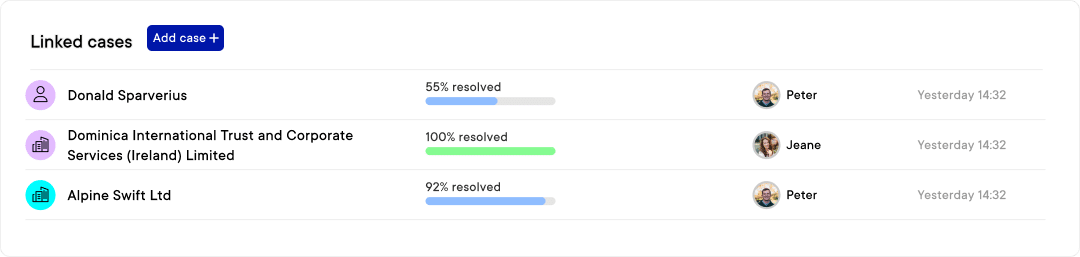

Accurate Entity Screening

Pascal offers comprehensive screening capabilities, covering sanctions, enforcements, PEPs, adverse media and ICIJ leaks. Our solution enables you to stay updated with continuous monitoring and real-time alerts, eliminating the need for periodic checks. Pascal Insight data packs, carefully curated and continuously updated 24/7, deliver faster and more accurate results compared to other tools.

Real-time alerts

Comprehensive screening and monitoring

Full audit trail

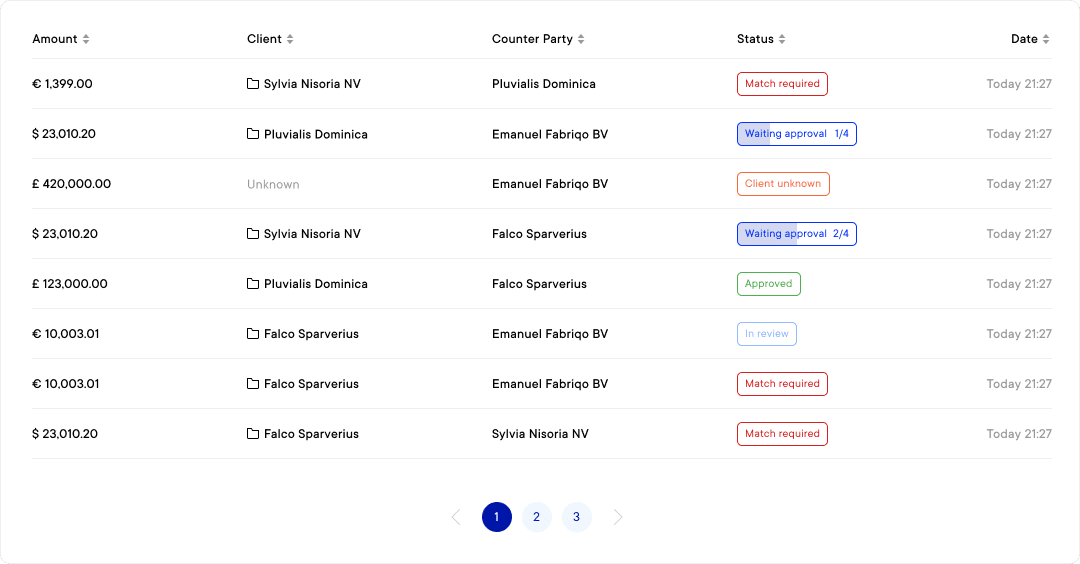

Efficient Transaction Monitoring

Our Transaction Monitoring solution empowers you to effectively track and analyse transactions as well as directly screen the parties involved. With custom transaction profiles that fit your business needs and integrated Entity Screening, you will stay ahead of the competition, managing your compliance faster and more accurately. With an integrated approval flow and a comprehensive audit trial, the solution ensures transparency and accountability in every decision.

Integrated entity screening

Custom transaction profiles

Approval flow with full audit trail

How we Impact your Peers’ Business

Discover why Pascal is trusted by over 600 users.

“What I like best about Pascal is its risk-based approach and the confidence indicator, which allows me to focus only on what really matters.”

“The best part of Pascal is probably the amazing team behind it, who are always happy to engage in discussions about how to utilise it efficiently, and who take the time to consider and often implement any suggestions users have.”

“The HubSpot integration with Pascal works perfectly, and the results are very intuitive and easy to understand.”

Your Questions Answered

Why should I choose Pascal?

Pascal is your choice if you aim to streamline compliance with greater efficiency. As a complete ecosystem for KYC and AML processes, Pascal aids you during client onboarding, entity screening and transaction monitoring, allowing you to focus on high-risk areas while minimising manual efforts. Moreover, its AI-driven technology provides real-time alerts, accurate risk assessments and continuous monitoring, ensuring that you always have up-to-date and relevant information to assess risks faster and more accurately.

What is a comprehensive KYC & AML ecosystem?

Our comprehensive KYC & AML ecosystem is an integrated system that covers all aspects of compliance. Starting with the onboarding of new clients, Pascal supports you with the collection and validation of essential documents and data. But while that is happening it directly integrates that data into entity screening, combining several process steps seamlessly. And with transaction monitoring, you can track transactions, identify suspicious activities and prevent fraudulent transfers, ensuring full compliance with AML regulations. All these functions require minimal manual effort, guaranteeing greater efficiency and accuracy.

Which data sources are included in Entity Screening?

We offer a comprehensive range of data sources to ensure thorough compliance checks. This includes global sanctions lists such as OFAC, SECO and the EU Financial Sanctions, enforcement actions from various regulatory bodies and a database of Politically Exposed Persons (PEPs). Additionally, over 100 million curated media articles with adverse and negative mentions are ready to be screened, providing extensive coverage of financial crimes, corruption and other risks. With Pascal, you skip false-positive hits and only assess what matters to your business.

How accurate and up to date is the data in Entity Screening?

Our data is constantly updated, with the majority of sources refreshed every one to two days. We ensure high accuracy through a series of integrity checks, governed by our ISAE3402-II assurance, and regular reviews by compliance experts. Our proprietary AI models, developed by Vartion, further refine the data, providing you with reliable and up-to-date information for your compliance requirements.

Schedule a Meeting

Join forces with Vartion to streamline your compliance processes and drive operational efficiency. Pascal empowers your business to stay ahead of risks, ensuring seamless client onboarding and screening as well as transaction monitoring.